A home equity line of credit (HELOC) is a loan that allows homeowners to borrow against the equity in their home when needed. What's the HELOC maximum loan amount you can borrow? There are a few factors that impact your borrowing power with a HELOC. Here’s what you need to know.

How do HELOCs work?

A HELOC lets homeowners tap into their home equity as needed. It doesn't replace your current mortgage— it's a separate loan that functions as a revolving line of credit.

Most HELOCs have a draw period of 5 to 10 years. During that time, you can borrow as needed (up to your credit limit) and make interest-only payments on the loan. Once the draw period ends, you can no longer borrow funds, and you'll start repaying the principal and interest on the amount borrowed.

How long does it take to get a HELOC? Better offers a One-Day HELOC with a simple online application process, with underwriting determination within 24 hours.

How much money can you take out on a HELOC?

What is the maximum home equity line of credit that you can get? How much money you can take out on a HELOC depends on your home’s current market value, how much you owe on your mortgage, and the percentage of your home value your lender will allow you to cash out.

Most lenders let homeowners borrow up to 80% of their home value, minus what they owe on their mortgage. But Better lets qualified homeowners borrow up to 90%, up to $500,000

What determines your maximum HELOC amount?

Numerous factors influence your borrowing capabilities. To determine whether you qualify for a HELOC and HELOC maximum loan amounts, lenders consider the following:

Home equity

To qualify for a HELOC, you must have a sufficient amount of equity in your home. Many lenders require applicants to have at least 15% to 20% equity to be eligible for a HELOC.

To calculate how much equity you have, subtract your remaining mortgage balance from your home's current market value.

To calculate the percentage, divide your home equity by your home's current market value and multiply by 100.

Your lender will likely require an appraisal to determine the market value of your property.

Loan-to-value ratio (LTV)

Your loan-to-value ratio (LTV) compares your total debt against your home’s market value. LTV is another factor that impacts HELOC borrowing limits. Lenders calculate your LTV to determine how much of your home's value can be used as collateral for a HELOC loan.

As mentioned above, most lenders let homeowners borrow up to 80% of their home value, minus what they owe on their mortgage and any other loans secured by their property.

Typically, with a lower LTV, you'll be eligible for a larger HELOC. A lower LTV can also help you qualify for a lower interest rate.

Debt-to-income ratio (DTI)

Lenders want to feel confident that you’ll be able to repay the money you borrow. That’s why they consider your debt-to-income ratio, or DTI, which is a measurement of your monthly debt payments compared to your gross monthly income.

**Your DTI helps lenders gauge the risk associated with lending you money. Having a lower DTI is preferable and will put you in a better position to borrow more. Many lenders require applicants to have a DTI of 40% or less. Better allows a maximum DTI of 50% for qualified borrowers.

Credit score

Lenders set minimum credit score requirements for their products. Your credit score shows lenders your ability to manage credit and repay debt. Your credit score and credit standing can impact your ability to qualify for a HELOC and can also influence your maximum HELOC limit.

How to calculate potential HELOC borrowing power

What is the maximum HELOC amount you might qualify for?

To determine your potential HELOC borrowing power, take these steps:

— Determine your home’s market value. Looking at recent sales for similar properties in your area can help you estimate your home value or get a professional home appraisal.

— Calculate your maximum loan amount. Ask your lender their maximum LTV ratio and multiply your home’s market value by this percentage. This is the maximum amount you can borrow in total, including your current mortgage balance and any new loans.

— Calculate your potential HELOC borrowing power. Finally, subtract your existing mortgage balance from the above maximum loan amount. This number is your maximum potential HELOC borrowing power.

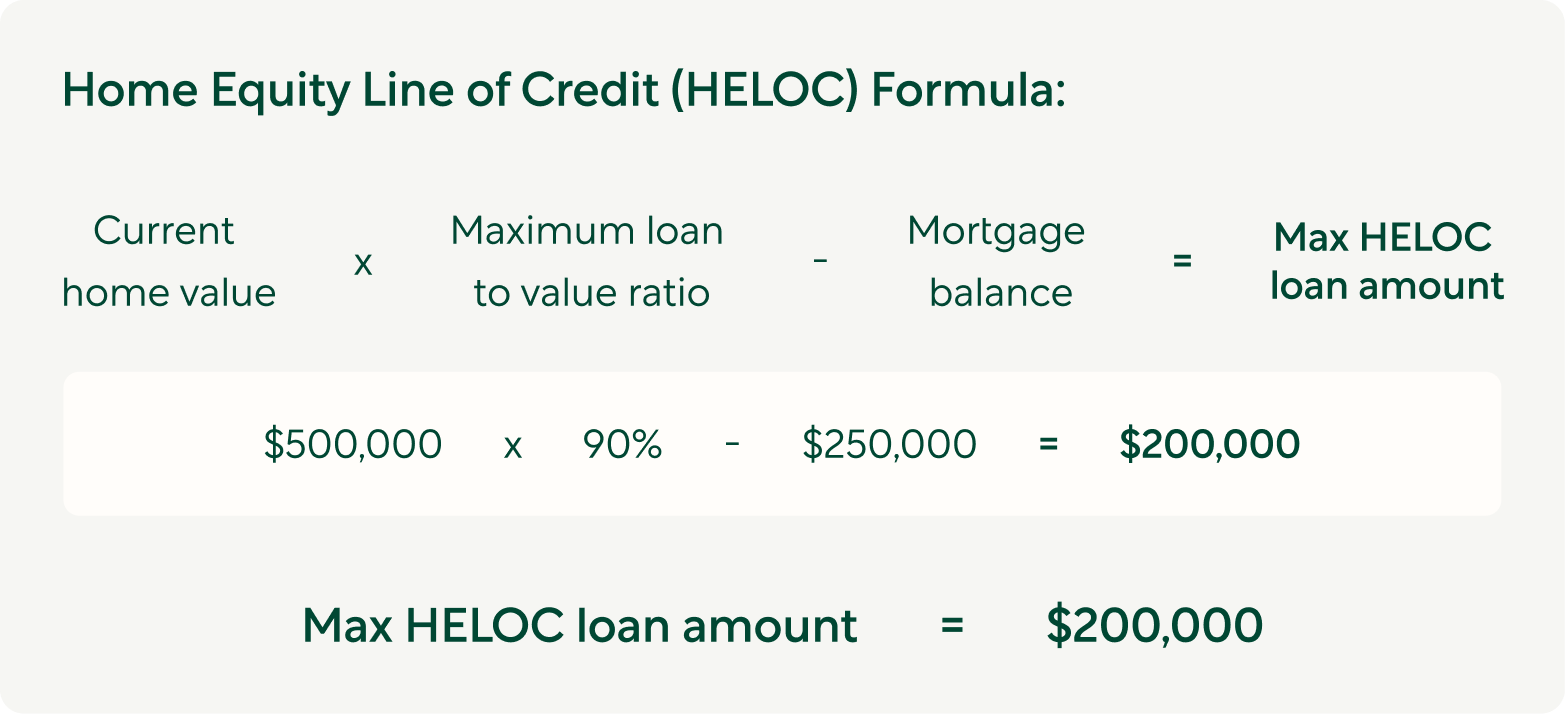

Let’s imagine you want to tap into your home's equity. Your home’s current value is $500,000, you owe $250,000 on your mortgage, and your lender’s maximum LTV ratio is 90%.

Here’s the equation you’ll use to determine your potential maximum HELOC loan amount:

Current home value x maximum LTV - mortgage balance = maximum HELOC loan amount

$500,000 x .90 - $250,000 = $200,000.

The maximum HELOC amount you could potentially qualify for is $200,000.

A home equity line of credit payment calculator can help you estimate your monthly payments.

...in as little as 3 minutes – no credit impact

How to increase HELOC limits?

It may be possible to increase HELOC borrowing limits. But it’s not something that happens automatically. Nor is it guaranteed.

If you need to increase your HELOC limit, here are a few options to explore:

— Loan modification: Check to see if your current lender will adjust the terms of your HELOC. When a lender agrees to make changes to your loan terms, it’s called a loan modification. Some lenders could be willing to modify your loan to increase HELOC borrowing limits.

— Refinance your HELOC: Another option is refinancing your HELOC. When you refinance a HELOC, a new loan replaces your existing HELOC. If your home has appreciated since you took out your HELOC, this may be a worthwhile option to explore.

— Get a new HELOC: Another solution is to get a new HELOC. You can either get a second HELOC or replace your current HELOC with a new HELOC with a larger borrowing limit. It could be possible to access higher borrowing limits and save money on fees and interest.

What’s the right amount of equity to borrow?

How much HELOC should you get? Should you finance the maximum credit limit available to you? When deciding how much to borrow, consider:

— Keeping some equity in your home: Keeping some home equity untouched can help provide financial security. You never know when an unforeseen financial emergency will occur, and having untapped equity can be helpful.

— Your reasons for borrowing money: It's best to use a HELOC to finance something that will provide long-term value. Examples include renovating or repairing your home or paying off high-interest debt. Ensure you're getting a HELOC for the right reasons.

— How much you need: The best strategy is to take out a HELOC for the amount of money that you need for your goal. You’ll pay fees and interest for any amount borrowed, so make sure you're not wasting money by taking out more than you need. Only borrow what you can afford to repay.

HELOC alternatives

If a HELOC isn’t right for you, other financing solutions exist.

Some HELOC alternatives include:

— Home equity loan: A home equity loan is a second mortgage that lets you borrow money using the equity in your home as collateral. The loan amount is dispersed as a lump sum, and you make monthly installments. Most home equity loans have fixed interest rates and fixed monthly payments.

— Cash out refinance: A cash out refinance is a type of mortgage refinance that lets you convert your home equity into cash. You replace your existing mortgage with a new one in exchange for a lump sum. Closing costs may apply with this kind of loan.

— Personal loan: A personal loan is an unsecured installment loan, meaning your home isn't used as collateral. A personal loan could be ideal if you need to borrow smaller amounts of money, to pay off debt, or to finance a less costly home improvement project. Personal loans typically have fixed interest rates and fixed payments. However, they usually come with higher interest rates since they are unsecured.

Maximum HELOC amount FAQs

What does the HELOC maximum loan amount depend on?

Your HELOC borrowing limit depends on how much equity you have, your lender's maximum LTV, and other factors, like your credit score. If your lender's maximum LTV is 90%, your home is worth $300,000, and your remaining mortgage balance is $165,000, the maximum loan amount you might qualify for is $105,000.

Is it possible to get a HELOC for 90% of my home's value?

It may be possible to get a HELOC for 90% of your home's value if your lender’s maximum LTV ratio is 90%. However, loan approval and HELOC limits depend on factors like your financial situation, credit score, and debt-to-income ratio.

Better is one of the few lenders that lets you borrow up to 90% of your home's value.

...in as little as 3 minutes – no credit impact

What are the requirements for a HELOC?

To be eligible for a HELOC, you must have sufficient equity in your home. Lenders typically require homeowners to have at least 15% to 20% home equity. You must also have enough income to afford the monthly payments. Factors such as your available equity, credit score, and debt-to-income (DTI) ratio can impact whether you qualify for a home equity line of credit.

Conclusion

If you're interested in funding a home improvement project, paying off debt, or financing other needs with a HELOC, maximum home equity line of credit amounts matter. Calculating the HELOC maximum loan amount you might qualify for can help you determine whether a HELOC is the ideal solution for your situation. Ready to get a HELOC? Apply for pre-approval.

...in as little as 3 minutes – no credit impact