How often can you refinance a mortgage? Rules & timing

How often can you refinance a mortgage, understand common seasoning rules, costs, pros and cons, and how to decide if refinancing again is truly worth it.

Read more

How often can you refinance a mortgage, understand common seasoning rules, costs, pros and cons, and how to decide if refinancing again is truly worth it.

Read more

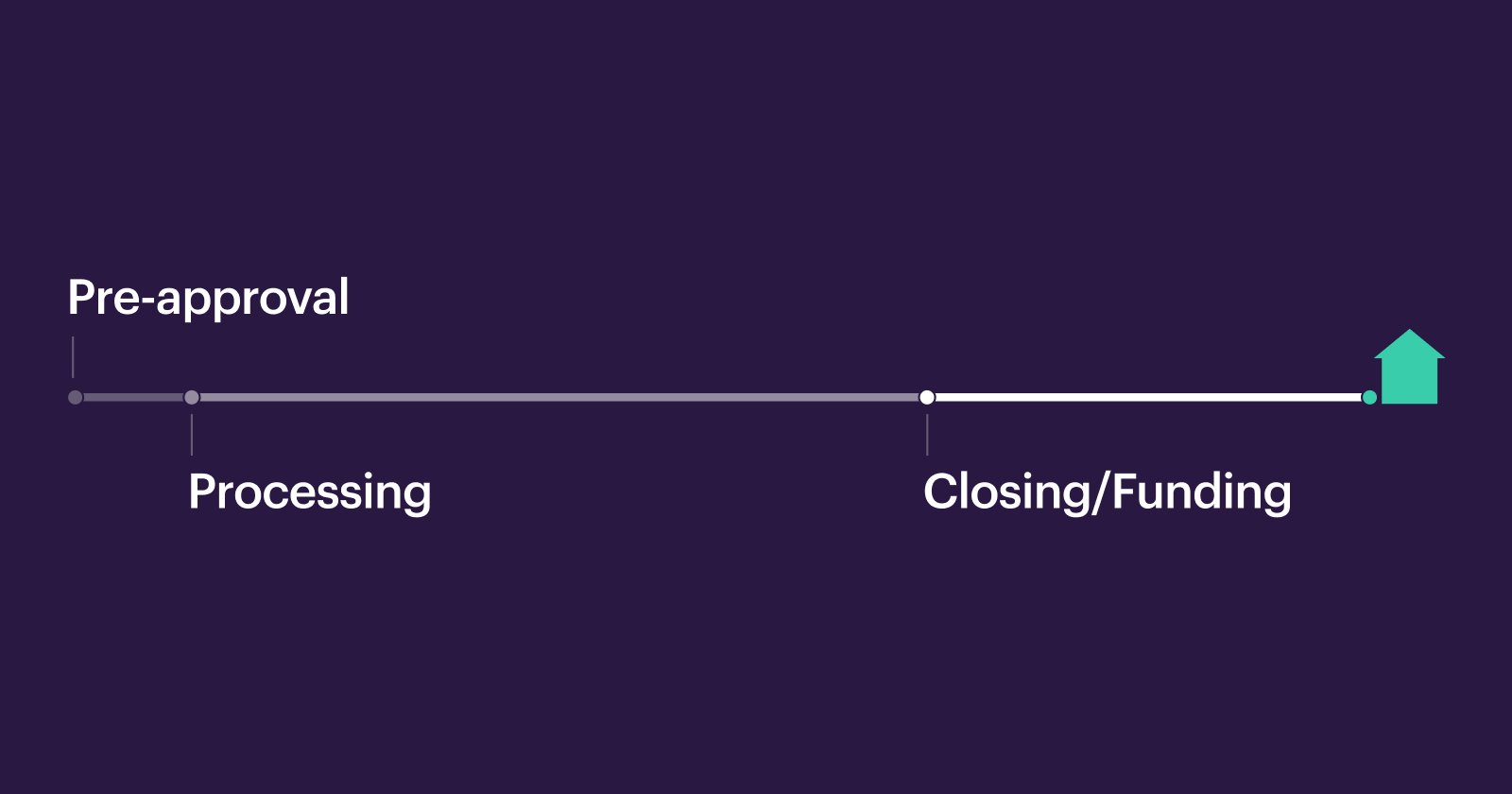

Explore our detailed home buying process timeline to understand each step from pre-approval to closing and learn how to move forward with confidence.

Read more

See how to buy a house without a real estate agent; weigh what you’ll miss, when DIY works, and the essential steps and safeguards to navigate the purchase.

Read more

If you’re applying for a mortgage or refinancing, you’ll need to “lock” your rate during the loan process. Here’s a breakdown of what exactly that means.

Read more

Learn the key difference between mortgage APR and interest rate, and how each affects the true cost of your loan, monthly payments, and overall home financing.

Read more

Learn how to navigate buying a new construction home—from the home loan process, through assembling your team, and how you can avoid predatory lenders.

Read more

Understand how interested party contributions can impact your loan, LTV ratio, and closing costs. Get clear information on what to watch for before you close.

Read more

Discover what affects a home appraisal for refinance, including how cleanliness and other factors may influence its value. Learn what appraisers look for and how to prepare your home.

Read more

Learn how a CEMA New York loan helps reduce mortgage tax costs when refinancing, how it works, and whether it's the right option for your home loan needs.

Read more

When you apply for a mortgage, your lender might ask for your tax returns. Here's why they’re requested and how they can affect your mortgage application.

Read more

More than half of homebuyers with children in school shop by school district. Here's what to know about the impact that can have.

Read more

Thinking about refinancing your mortgage? Learn when to refinance, the benefits, and key factors to help you decide if now is truly the right time for you.

Read more

Discover how mortgage points and credits affect upfront costs and rates, locate them on your loan estimate, and compare loan expenses confidently and easily.

Read more

If you share our values and have the skills to help us make homeownership simpler, faster, and more accessible for everyone, we’d love to have you on our team.

Read more

In 2018, we simplified homeownership, helped thousands save time, money, and stress, expanded to 35 states, and built momentum for an even better 2019.

Read more

Real estate PMI, or private mortgage insurance, is required for low down payment mortgage loans. Learn about how real estate PMI can impact your mortgage costs.

Read more

Here’s how you can put down roots and buy a house without having to give up your dreams of traveling the world.

Read more

At Better Mortgage, we give them the best mortgage price possible. So how do we make money?

Read more

Chances are you want to get a good deal on your mortgage. This post is all about breaking down mortgage rates and costs, so you can be a savvy shopper.

Read more

Buying a home with a significant other, family member, or close friend? Here’s how to decide whether or not to include them on the mortgage.

Read more

Need something else? You can find more info in our FAQ