Loan subordination, refinances, and closing delays

Discover how loan subordination lets you refinance while keeping a second mortgage: What it is, how it works, key steps, and why it’s important.

Read more

Discover how loan subordination lets you refinance while keeping a second mortgage: What it is, how it works, key steps, and why it’s important.

Read more

Wondering if getting pre-approved hurts your credit? Discover how credit checks work and simple ways to keep your score safe during the mortgage process.

Read more

Homeowners who were previously denied a mortgage refinance may now qualify through RefiPossible™. You may save up to $3k/yr by lowering your monthly costs.

Read more

Can’t afford surprise repairs or vet bills? Learn how to protect your home, belongings, and pets with affordable insurance from Better Cover and Lemonade.

Read more

Understand appraisal contingency: how it protects buyers, affects mortgages and LTV, options when appraisals are low, and when it’s smart to safely waive.

Read more

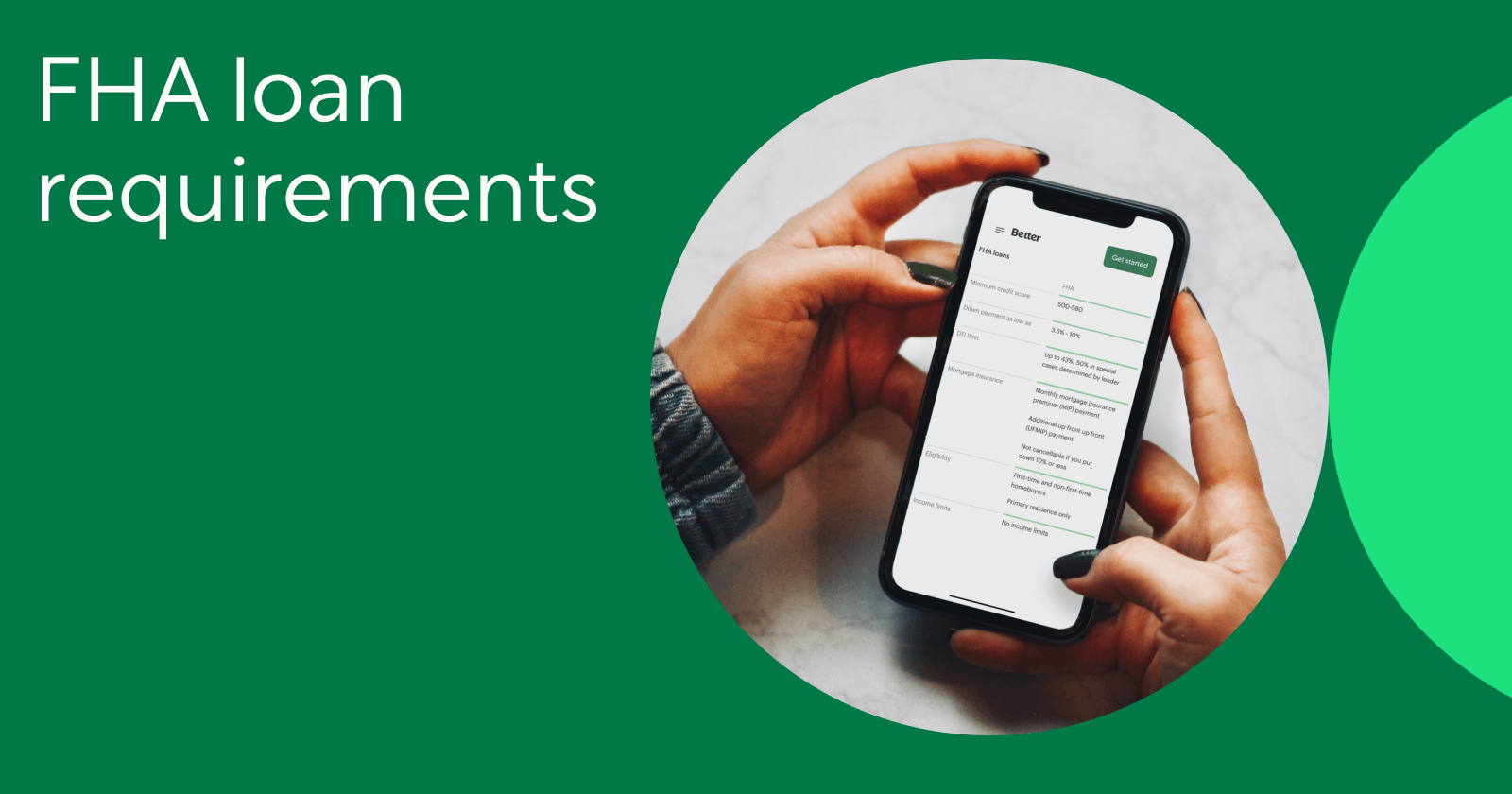

Explore FHA loan essentials: credit score and down payment thresholds, DTI, MIP costs, property standards, and how to apply with government-backed flexibility.

Read more

What is an FHA loan? Understand how FHA-backed mortgages work, who qualifies for them, the minimum credit and down payment, pros and cons, and steps to apply.

Read more

Tips for comparing the affordability of renting and buying a home, and deciding which one might be right for you.

Read more

Get approved for a mortgage for self-employed borrowers: understand income docs, tax write-offs, down payment proof, and tips to boost eligibility with lenders.

Read more

How are real estate taxes calculated? Learn what affects them, how to potentially lower your bill, and how they impact your home search, upgrades, and budget.

Read more

Looking for mortgage advice? This guide breaks down rates, refinancing, and top FAQs to help you choose the best loan and timing for your home financing goals.

Read more

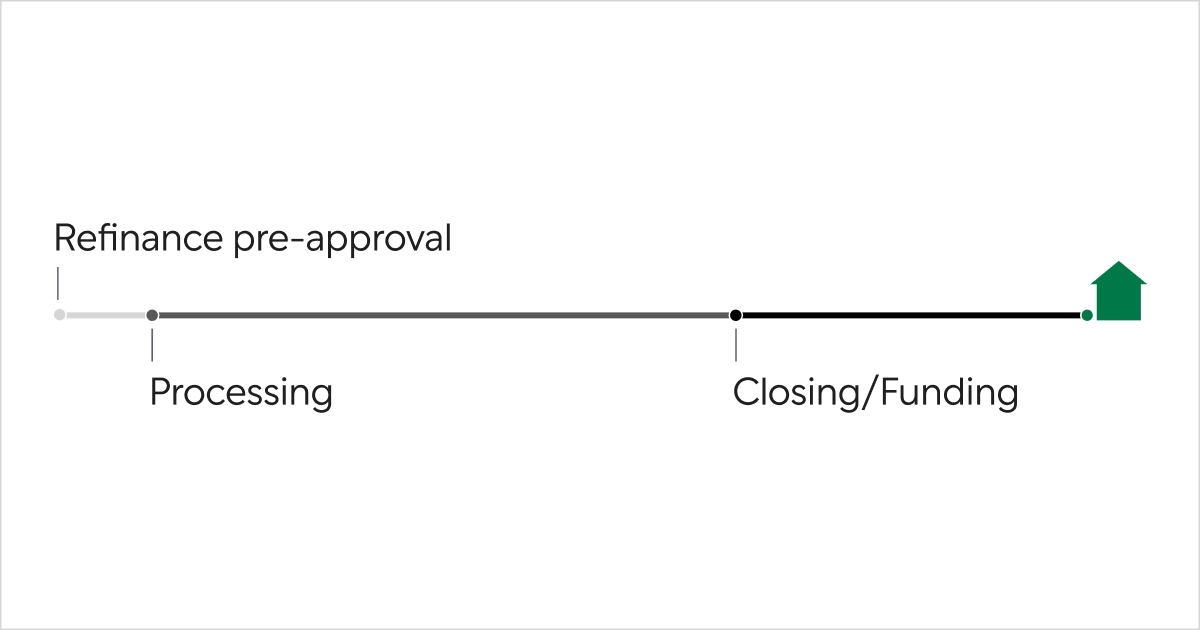

Refinancing can help homeowners save money, but the process can be complex. Here's how Better simplifies it and what you can expect from start to finish.

Read more

Learn what makes property value increase and learn 10 important factors that significantly impact how much a home is worth when buying, selling, or refinancing.

Read more

HomeReady vs FHA loans: See how an affordable home financing program that offers low down payment options like HomeReady stacks up against FHA loans.

Read more

Mortgage application denied? Discover common reasons for denial and expert tips to strengthen your next application and boost your chances of getting approved.

Read more

Learn what a closing package is, why it matters, and how it finalizes your home purchase so you can confidently navigate the last step of the mortgage process.

Read more

Learn how a loan estimate reveals real mortgage costs, compares lenders, and highlights fees you can control. Explore its sections and compare offers clearly.

Read more

In the socially distanced world of 2020, Better helped 88,100+ new clients navigate their homeownership journey with ease, confidence, and a ton of savings.

Read more

Refinancing may help you save money and give you access to your home equity. Here are the pros and cons of refinancing, and scenarios when it makes sense.

Read more

Consolidate high-interest debt with a cash-out refinance from Better Mortgage.

Read more

Need something else? You can find more info in our FAQ